Trust Management

Portfolio Parameters

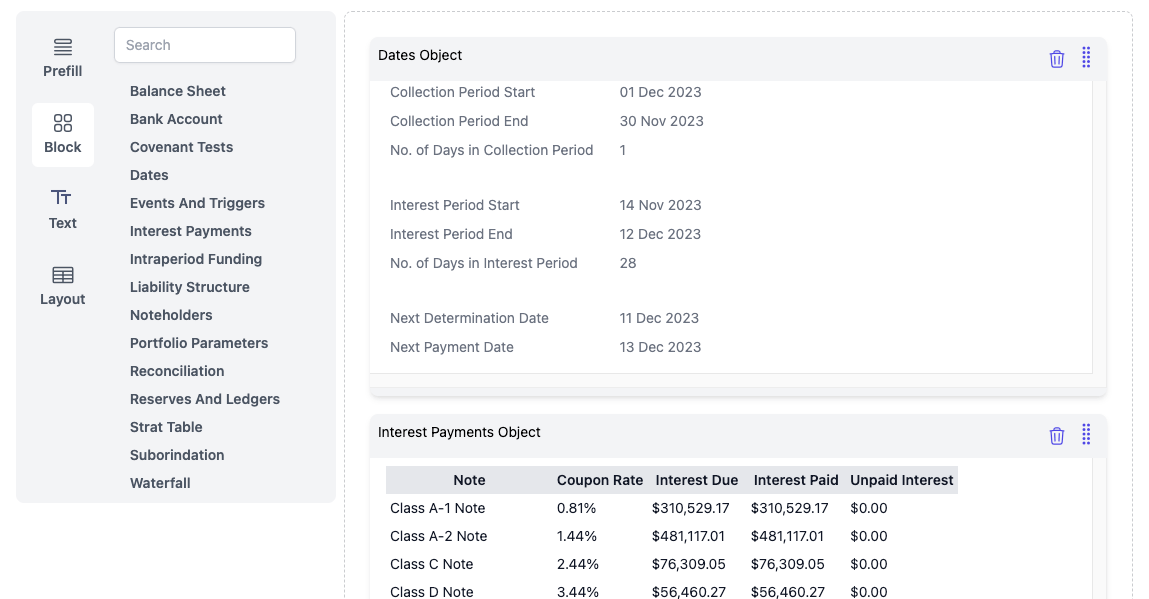

Managing portfolio parameters and monitoring their performance over time is one of the advantages of the Sequential trust management platform. With a powerful yet simple interface, create portfolio parameters without a single line of code or complex formula in Excel.

Whether parameters are geographic exposure limits, specific risk factors associated with segments of the pool or loan to value ratios, the Sequential platform handles them all. Large data sets are processed in real time checking headroom and instilling confidence.

Events

Establish the full range of events, triggers and outcomes to be monitored and modelled in the Sequential trust management platform. These include amortization, step up, step down, stop funding, turbo events and more. Have the confidence that waterfalls are calculated correctly every time, in every scenario.

Data Management and Validation

Confidence in your end of month reports starts with having confidence in your data inputs. Sequential's trust management software is built on a robust foundation of data integrity and data management - not just once, but every time your data touches the Sequential platform.

Sequential allows you to create a data template that controls the expected fields and values of your pool cut data. Every time your loan data comes into Seqential (via API, SFTP or uploading a file) the incoming data is checked against the template you have created.

If incoming data doesn't match your data template and rules, you will be alerted to any that have failed validation. Because the Sequential trust management platform is built for usability, if columns are out of order or a new column is introduced into your data set, it won't break the system! Sequential automatically reorders jumbled columns and new columns are identified and you'll be prompted to either ignore the new column or add it into your data template moving forward.

Sequential builds confidence in your trust management processes every step of the way.

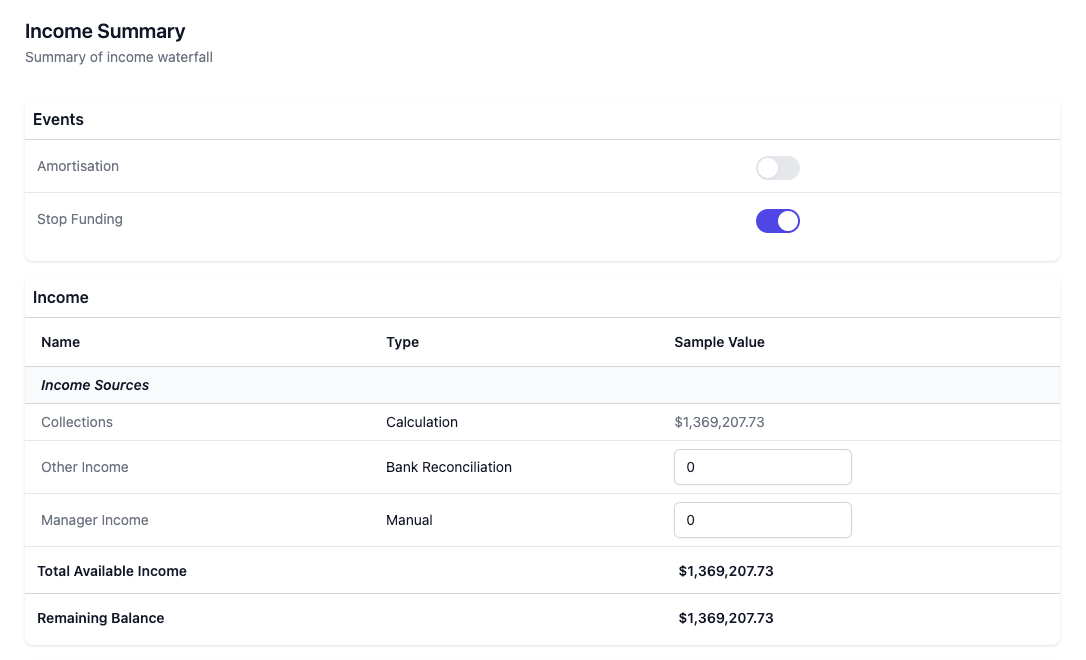

Waterfalls

The Sequential trust management system ensures every aspect of income and principal waterfalls are set up correctly. Use historical data to build out templates that include income sources, required and subordinated expenses, noteholder interest, principal sources and allocations. Use digital ledgers to ensure all important information is tracked and managed from period to period. Build confidence by testing the impact of events, adding income traps and principal releases, to ensure that waterfalls are calculated correctly every time, in every scenario.

Eligibility Criteria

Building eligibility criteria in the Sequential trust management platform is a breeze. With intuitive UI and logical process flow, Sequential enables treasury team members to create EC's without coding, complex Excel formula or sending requests to a technical team.

Based on the data fields from your own data template, quickly and easily create new eligibility criteria when setting up a trust. Or if an EC is being amended by agreement with a funder, then it's a simple edit.

Sequential offers a hierarchy of user permissions, so EC's can be created or edited by one of your team, but then checked and locked down by an authorising team member.

Automatically test EC's when selling loans into a warehouse, receive alerts of breaches and add waivers as needed with just a few clicks.

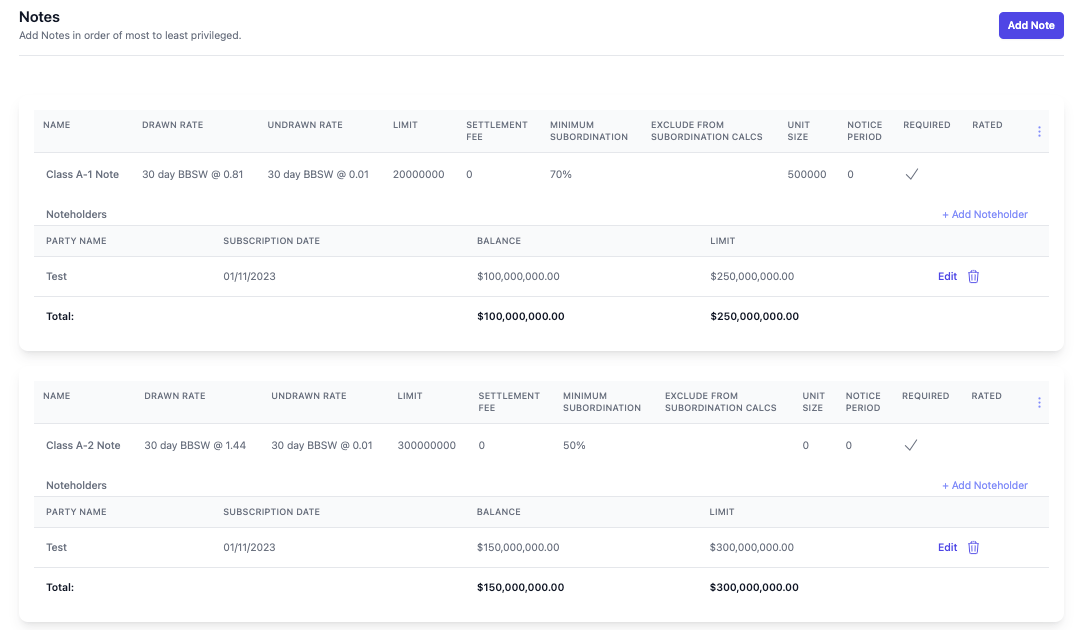

Noteholders

Sequential includes a complete noteholder management module. Record all parties connected to each note, subscription date, drawn rate, undrawn rate, minimum subordination requirements and more.

Noteholder details are linked directly to waterfall calculations, end of month reports and subscription processes. Like all features of the Sequential platform for treasury and securitisation teams, you have visibility and confidence of the data inputs that produce the month end reports for you investors and internal management.

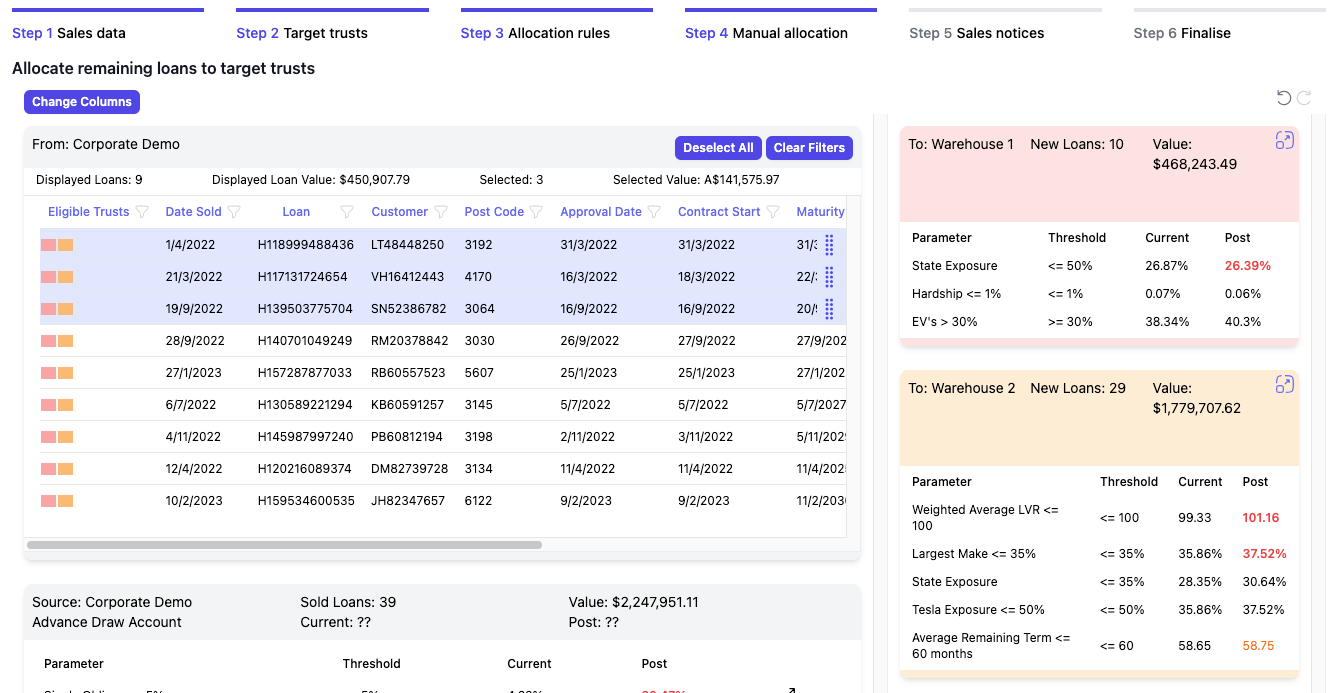

Sales and Reallocation

Automate allocation and reallocation of loans to trusts using the Sequential platform. Sell into one, or many, warehouse facilities using a single, intuitive, process that checks eligibility criteria and monitors portfolio parameters pre and post allocation.

Send notices to your trustee and funders along with a feedback loop to connected loan management systems ensuring everything is recorded accurately.

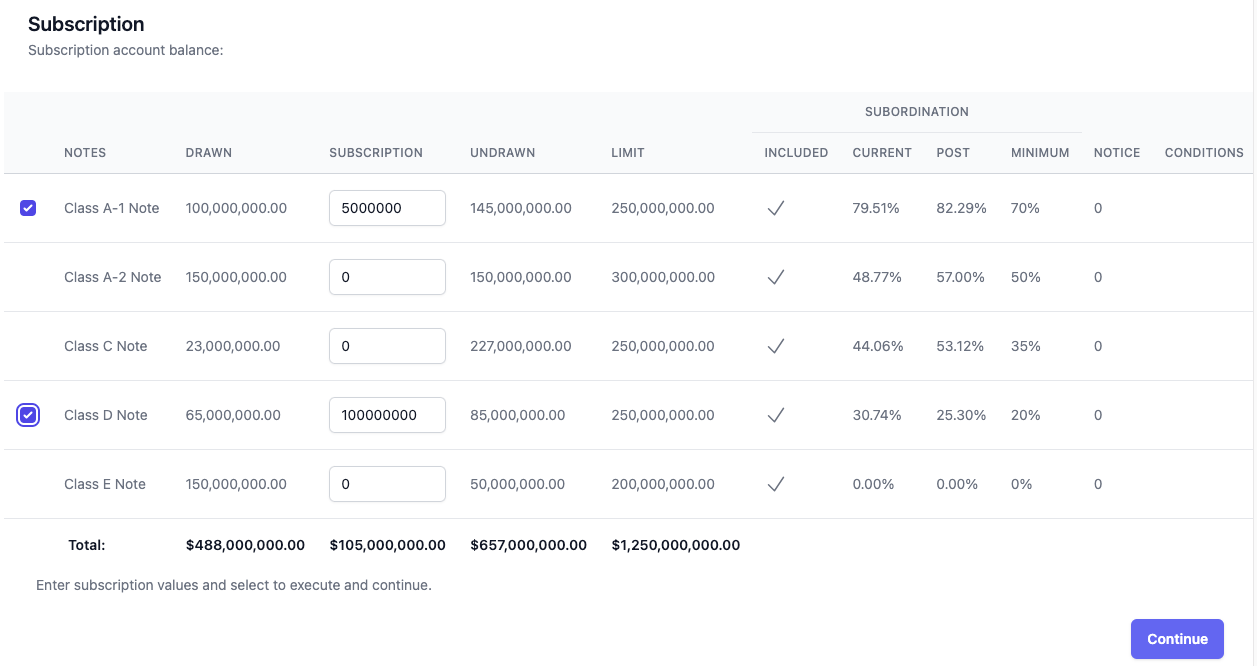

Subscription

The Sequential trust management platform maintains the live liability structure of notes. Complete subscriptions in a single screen that displays drawn and undrawn amounts as well as limits and conditions from funders. Monitor real-time subordination levels pre and post the subscription process and communicate funding requests automatically to provide liquidity as needed.

Reports

The Sequential custom report builder is flexible and is a critical part of delivering next level capabilities to treasury teams. Easily configure manager, collections, trigger and stratification reports using intuitive templates to ensure trustees, investors and regulators receive accurate information on time.